debit and credit in accounting

Fortunately computerized accounting systems help in this process minimizing errors while automatically performing many tasks. The following are the accounting records for both purchases on credit and cash purchases.

Financial Accounting What S The Deal Clip With Debits And Credits Icas

Debit note acts as the Source document to the Purchase returns journal.

. If the amount has been debited into accrued expenses do we need to credit it after making the payment so that the balance would be zero in accrued expenses. This data suggests that debit cards and credit cards are used at a similar rate. Accrued Expenses Journal Entry.

During voucher entry the cursor may stop in the DrCr field in the Bill-Wise Details screen when the symbols for debit and credit are not specified. If debit increases credit decreases and. When recording a transaction every debit entry must have a corresponding credit entry for the same dollar amount or vice-versa.

In other words it is an evidence for the occurrence of a. The Finance System is a double-entry accounting system. A debit is an accounting transaction that increases either an asset account like cash or an expense account like utility expense.

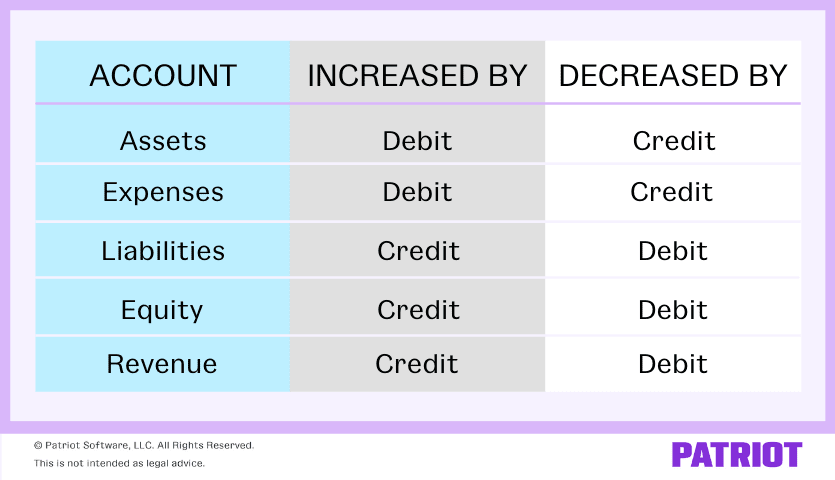

Accounting for inventories can be complicated with specific rules for debits and credits affecting various accounts. By Anonymous Unknown Question. The terms debit and credit signify actual accounting functions both of which cause increases and decreases in accounts depending on the type of account.

While keeping an account of this transaction these accounting tools debit and credit come into play. Debit and Credit Entries In Accounting What is a Debit. The rules for inventory accounting in the United States are governed by.

This means that entries of equal and opposite amounts are made to the Finance System for each transaction. In contrast liabilities are on the right side of the equation so a debit will. Debits are always entered on.

Debit and Credit are the two accounting tools. Answers-True or False ˇ ˆ. A debit note or debit memorandum memo is a commercial document issued by a buyer to a seller as a means of formally requesting a credit note.

Business transactions are to be recorded and hence two accounts which are debit and credit get facilitated. In accounting it is of utmost importance as every single transaction affects both of them that they cannot be bifurcated from each other. Debits go on the left and they either increase or decrease accounts depending on the type of account.

To record the bank credit memo the company will debit Cash and credit another account. The debit and credit rules are the heart of accounting and their understanding is extremely important for any individual involved in accounting system of a business entity. In article business transaction we have explained that an event can be journalized as a valid financial transaction only when it explicitly changes the financial.

Before looking at our sample transactions lets review. Debit and Credit both refer to the two hands of the same body. In some cases two accounts may receive the debit or credit.

The debits and credits mentioned in the question above are a bit confusing. Debits and credits are used in a companys bookkeeping in order for its books to balanceDebits increase asset or expense accounts and decrease liability revenue or equity accountsCredits do the reverse. Press F1 Help Settings Display click Show More.

Accounting Test Question With Answers On Accounting Equation and Debit And Credit _____ Page 9 ˇ ˆ ˇ ˇ ˇ ˆˇ Section A. Thats why simply using increase and. These are the events that carry a monetary impact on the financial system.

As a matter of accounting convention these equal and opposite entries are referred to as a debit Dr entry and a credit Cr entry. Cash purchases have happened when an entity makes a purchase of goods or renders the services and then makes the payments by cash immediately. The companys Cash account needs to be debited because its asset has increased.

DEBIT AND CREDIT CONVENTION. For example assets are on the left side of the accounting equation so a debit will increase an asset account. When recording a transaction or journal entry in accounting software such as QuickBooks or Sage Accounting Peachtree one account is debited and another account is credited.

Bookkeeping Basics to Remember. To fix this issue you have to specify the format for debit and credit amounts. For example if the bank statement shows a credit memo of 20 for interest earned the company will debit Cash for 20 and credit Interest Income for 20.

Select the formats for credit and debit amount. According to findings from the Federal Reserve Bank of San Franciscos Diary of Consumer Payment Choice consumers used debit cards for 28 of payments and credit cards for 27 of payments in 2020. For 19 of transactions consumers used cash.

Understanding Debits And Credits In Accounting Video Lesson Transcript Study Com

What Is A Debit And Credit Bookkeeping Basics Explained

Debit And Credit In Accounting Double Entry Bookkeeping

Debits And Credits In Accounting Patriot Software

Debits And Credits A Simple Visual Guide Bench Accounting

What Is The Logical Foundation Of Debits And Credits Quora

La Paix Tax Accounting Co Ltd Debit Credit Rules In Accounting Facebook

Debits And Credits Normal Balances Permanent Temporary Accounts Accountingcoach

0 Response to "debit and credit in accounting"

Post a Comment